Financial Advisory AI: 6-Hour Documents Generated in 2 Minutes

Last updated on December 22, 2025

Financial advisors don’t get paid to write documents. They get paid to understand people, build trust, and guide decisions that shape retirements, protect families, and grow wealth.

A New Zealand financial advisory firm came to us because their advisors were trapped doing exactly that – spending 4-6 hours manually assembling each Statement of Advice. Intake forms, meeting notes, risk assessments, tax calculations, investment comparisons, cashflow projections. All compiled by hand into 15-20 page documents that must be accurate, compliant, and personalized.

The math doesn’t work. An advisor handling 10 new customers monthly spends 40-60 hours just on document creation. That’s a full week consumed by formatting and writing – not advising.

The Problem

This manual process creates three problems:

Time drain on high-value work. Advisors spend more hours on document assembly than on customer relationships and strategic planning. Every new customer means another half-day lost to manual compilation.

Inconsistency across advisors. Different writing styles and document structures make quality control difficult. Review cycles extend as managers check each SOA for compliance and consistency.

Scaling limitations. Advisory firms can’t grow customer capacity without hiring additional advisors or accepting longer turnaround times. Document creation becomes the bottleneck in the entire advisory process.

The Solution

An AI-powered document generation platform transforms raw intake data into complete, professionally formatted SOA documents in under 2 minutes.

The system works in three stages:

Data extraction. The platform ingests structured information from intake forms and advisor meeting notes. Type-safe data models validate all inputs – customer details, properties, retirement accounts, insurance policies – before processing begins.

Parallel AI generation. The system generates 14 document sections simultaneously. Narrative sections – risk assessments, recommendations – use domain-specific prompts. Financial sections – tax calculations, cashflow projections – use deterministic logic with jurisdiction-specific rules.

Document assembly. Generated content flows into professionally designed PowerPoint templates with conditional rendering based on customer circumstances. PPTX output lets advisors review and refine before delivery – adjusting wording, adding context, or customizing recommendations.

How We Built It

-

Hybrid Generation Architecture – LLM-based generation for subjective content (risk assessment, recommendations) combined with in-code calculations for financial modeling (tax rates, cashflow, projections)

-

Structured Prompt Engineering – Domain-specific prompts for each SOA section ensure consistent, compliant output with personalized direct speech

-

Template-Based Assembly – Dynamic content insertion into professionally designed templates with conditional page rendering based on individual profiles

-

Editable Output Format – PPTX delivery enables advisors to make adjustments before finalizing, maintaining human oversight while eliminating repetitive document creation

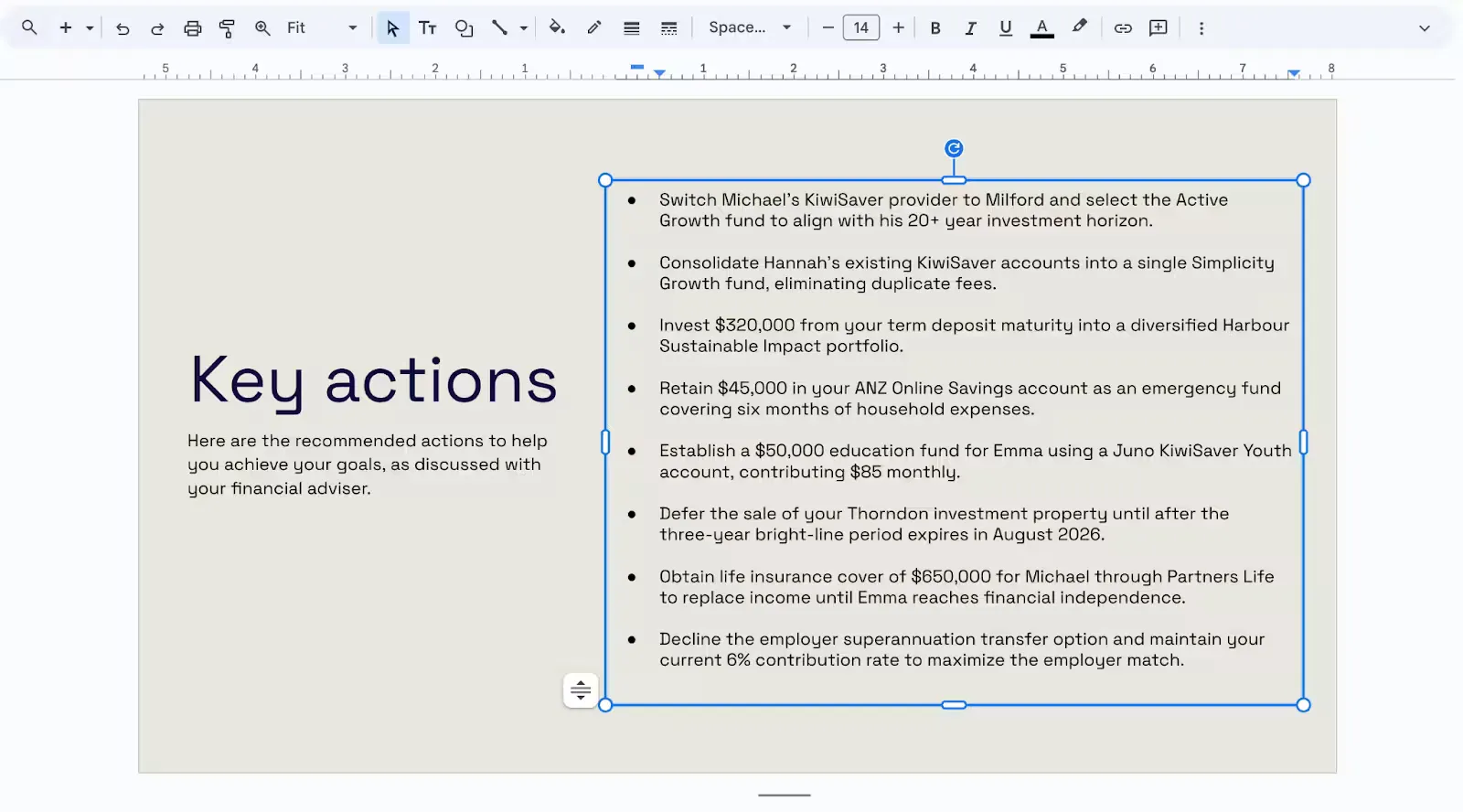

Below: a Key Actions slide generated from intake data. The advisor can adjust any recommendation before sending to the customer.

Technical Approach

The platform combines large language model flexibility with deterministic financial calculation reliability. Python’s ThreadPoolExecutor orchestrates parallel generation of 14 sections – reducing generation time from 15+ minutes to under 2 minutes.

Separating Narrative from Numbers

The system separates subjective narrative from objective calculation:

- Narrative sections – Risk assessments and personalized recommendations leverage Google’s Gemini 2.5 Flash

- Financial sections – Tax rates, cashflow projections, and balance sheets compute through type-safe Python data models

- Data extraction – 330+ line JSON schema parses intake forms into 12 domain models (Client, Property, RetirementAccount, InsurancePolicy, Budget) with built-in validation

- Domain rules – Jurisdiction-specific tax brackets, retirement account calculations, cashflow distribution, conditional rendering based on profile data

Section-Specific Prompts

A single generic prompt like “generate a complete SOA document” produces inconsistent results. Tone varies between sections. Domain requirements get missed. Output becomes unpredictable.

14 purpose-built prompts solve this. Each enforces exact structure, tone, and domain rules. Failures isolate to individual sections rather than breaking entire documents.

Document Rendering

The final stage injects generated content into professionally designed PowerPoint templates – AI-generated text, calculated figures, charts, and tables.

Why PPTX instead of PDF? Advisors need to review and adjust recommendations based on nuances the system couldn’t capture. An editable format maintains human oversight without sacrificing automation benefits.

The Result

| Metric | Impact |

|---|---|

| Document Preparation Time | 92% reduction (6 hours → 30 minutes) |

| Sections Generated | 14 specialized sections per document |

| Document Consistency | 100% across all advisors |

| Processing Architecture | Parallel generation of all sections |

Advisors provide intake data and meeting notes. Two minutes later, they receive a comprehensive Statement of Advice ready for review and delivery.

The 92% reduction in document preparation time translates to increased advisor capacity. Hours previously spent on document assembly now go toward customer relationships, discovery meetings, and strategic planning.

Consistent output eliminated quality control bottlenecks. Every SOA follows the same structure, meets the same compliance standards, and maintains the same professional presentation – regardless of which advisor initiated it.

The system handles jurisdiction-specific complexity automatically: tax bracket calculations, retirement account projections, and investment planning scenarios. Advisors no longer need to manually verify these calculations for each customer.